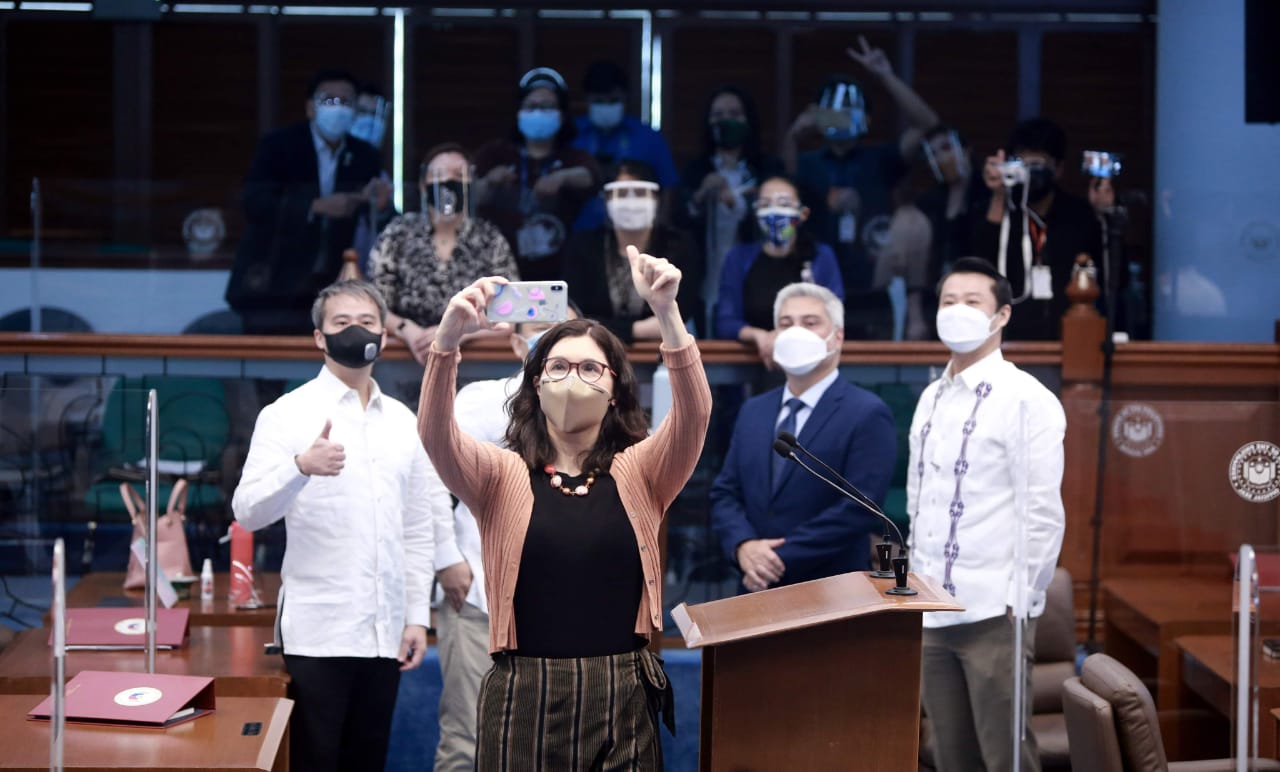

I am elated that the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Bill, which I have been working on since the start of the 18th Congress last year, has now passed the Senate on third reading. In fact, this bill’s earlier versions date back two decades ago.

In July of 2019, what we started with was the Corporate Income Tax and Incentives Reform Act (CITIRA) bill, which was passed by our counterparts in the House of Representatives. Shortly after the country was hit by the COVID-19 pandemic, the measure then evolved into the CREATE Bill, which seeks to (1) drastically reduce the Corporate Income Tax from 30 to 25 percent – to give businesses respite from the global crisis; and (2) ensure that tax incentives granted to qualified investors contribute to job generation.

The CREATE Bill that we finally passed in the Senate is the best version thus far, with more favorable tax rates granted to taxpayers, especially to our micro, small, and medium enterprises (MSMEs), VAT exemptions on critical medicines and PPEs, and more competitive incentives packages to attract the right kinds of investments into the country. Moreover, it would enable the Philippines to be at par with many of our ASEAN neighbors in attracting foreign direct investments, and firm up our efforts to build a stronger economy as we prepare for the challenges of the New Normal and beyond.

Leave a Reply